Opportunity Zones

Investing in Opportunity Act, known as “Opportunity Zones”, was passed as part of the Tax Cuts & Jobs Act of 2017. Qualified Opportunity Zones (QOZ) are low-income census tracts that were nominated by state governors and certified by the U.S. Treasury as qualified opportunity zones. More than 8,700 OZs have been approved. The intent of the program is to spur private capital investment into under-invested, economically distressed communities. U.S. Treasury regulations were finalized in April 2019.

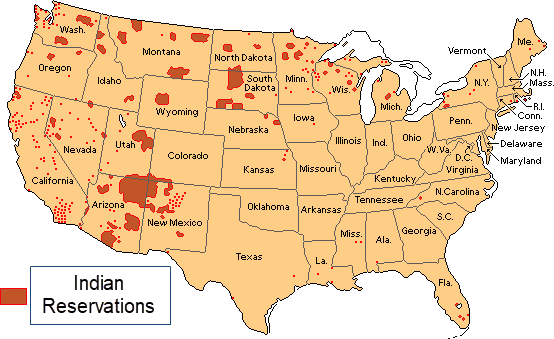

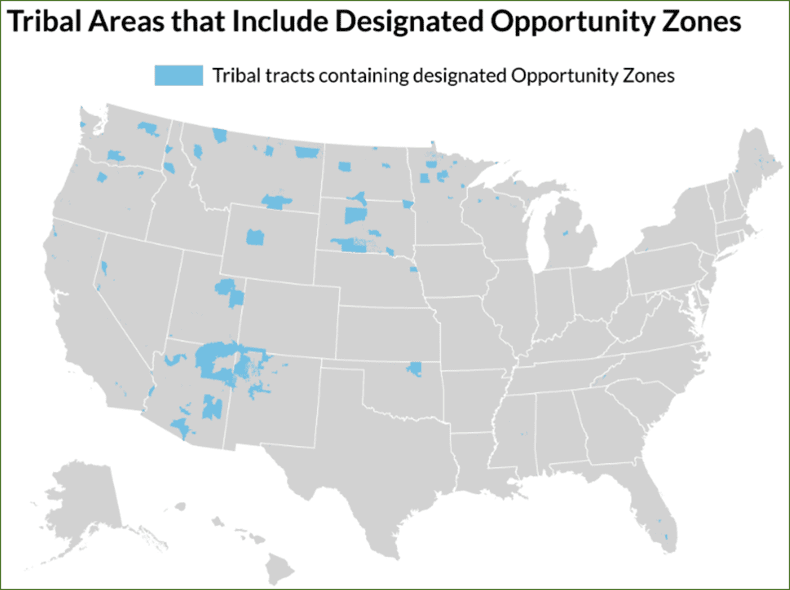

Of the 481 tribal census tracts across the country, 248 (or 52 percent) are in at least one census tract with Opportunity Zone designation. All 248 received at least one Opportunity Zone designation, representing approximately ten percent of all QOZ.

How can Tribes take advantage of these opportunities? A Tribe’s designated opportunity zone can be a magnet for economic development. 7G is working with many job creation opportunities from US and international interests that are interested in connecting with Tribes.

Opportunity Funds

According to Forbes, there are an estimated $6 Trillion sitting on the sidelines ready to invest in Qualified Opportunity Funds (OF), taking action in 2019 and 2020. A QOF is any investment vehicle organized as a partnership or corporation for the purpose of investing in one or more qualified opportunity zones. An OF must hold at least 90 percent of its assets in Qualified Opportunity Zone property, and they can be created to invest in a single project or multiple projects. 7G intends to form and manage several OF and seek investments from existing OF that will be drawn to the attractive returns from our hemp vertically integrated business model.

There are three tax incentives for investing in a Opportunity Fund in a Qualified OZ— deferral, reduction, and exclusion.

- Deferral of capital gains invested until December 31, 2026.

- Reduction of capital gains invested. The cost basis on the original capital gains invested in an QOZ fund can be stepped up by 10 percent after 5 years; and an additional 5 percent after 7 years, leading to a 15 percent reduction in capital gains tax.

- Exclusion of gain on Qualified Opportunity Zone investments held for at least 10 years, which includes OF investments that have matured several times as long as the investment stays within OZs.

What does this mean for Indian Country, and how can Tribes take advantage of Opportunity Funds? First, 7Gen works with OZ Funds managers for qualified projects located in Indian Country. Second, Tribes can co-invest in attractive projects for their prosperity. Non-Tribal investors will also invest in 7G Opportunity Funds and projects, for a variety of reasons. 1) Attractive investment returns; 2) Social, environmental and economic impact investments in American. There will be a significant flow of new capital attracted to investments in Indian Country that have not been available before. The results for participating Tribes serves their sovereignty and independence that will create good jobs and economic development.